How To Make Money With Crypto Arbitrage Trading

In the dynamic world of cryptocurrency, traders constantly seek strategies to maximize profits. One such strategy is crypto arbitrage trading, which involves exploiting price differences of the same asset across various exchanges. This method can yield consistent profits when executed correctly. This article delves into the intricacies of crypto arbitrage trading, exploring its types, tools, risks, and best practices.

Understanding Crypto Arbitrage

Crypto arbitrage is a trading strategy where traders buy a cryptocurrency at a lower price on one exchange and simultaneously sell it at a higher price on another. The profit stems from the price discrepancy between the two exchanges. These discrepancies arise due to factors like varying liquidity, trading volumes, and regional demand.

Types of Crypto Arbitrage

-

Spatial Arbitrage (Cross-Exchange Arbitrage): This is the most common form, involving buying a cryptocurrency on one exchange and selling it on another where the price is higher.

-

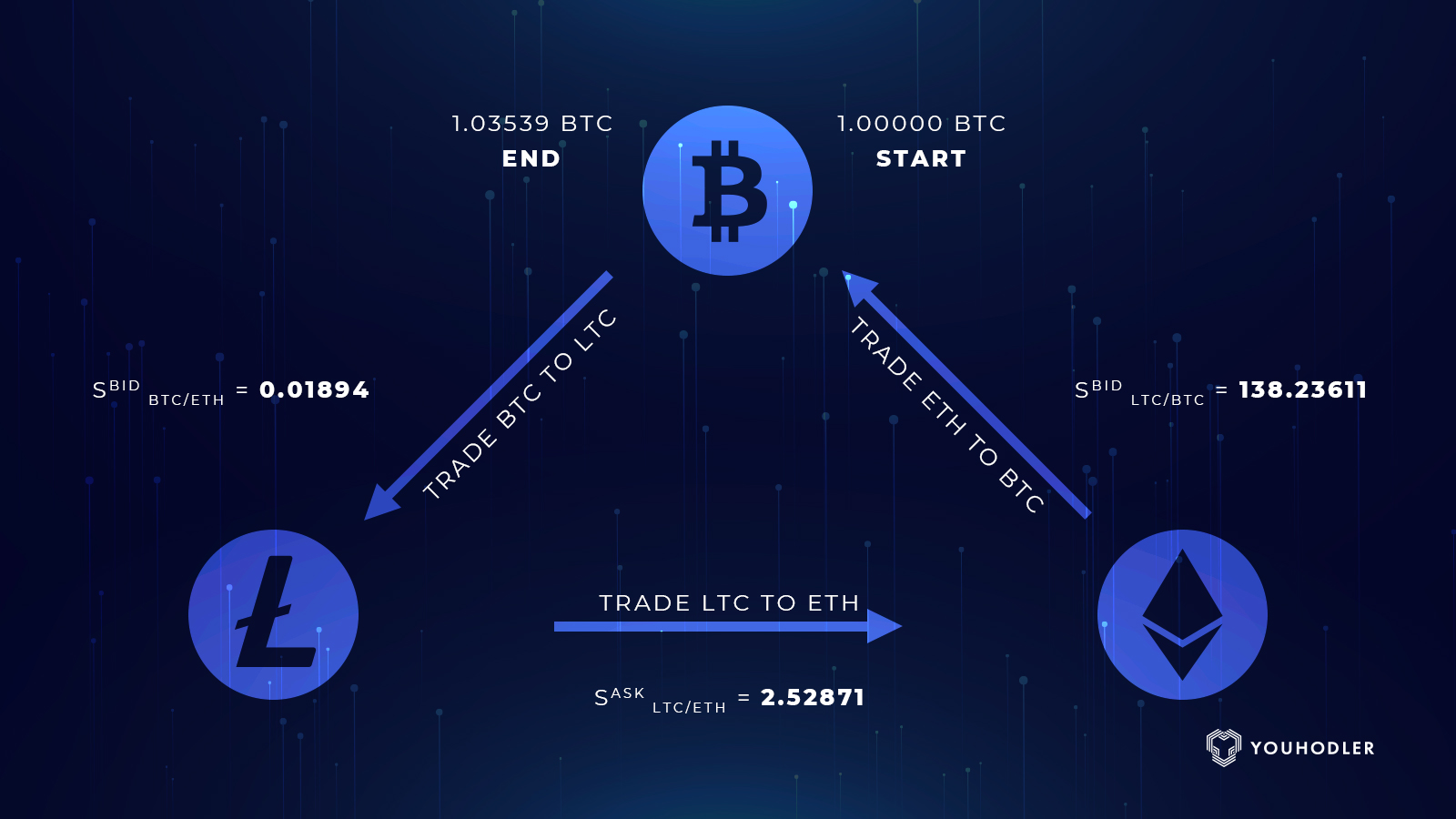

Triangular Arbitrage: This involves exploiting price differences between three different cryptocurrencies on the same exchange. For instance, trading BTC for ETH, then ETH for LTC, and finally LTC back to BTC, profiting from the discrepancies in exchange rates.

-

Statistical Arbitrage: This strategy uses mathematical models and algorithms to identify trading opportunities based on historical price data and statistical analysis.

-

Decentralized Exchange (DEX) Arbitrage: This involves exploiting price differences between decentralized exchanges, often using smart contracts to automate trades.

Tools and Platforms for Arbitrage Trading

-

Arbitrage Bots: Automated trading bots can monitor multiple exchanges simultaneously, executing trades when profitable opportunities arise. These bots can operate 24/7, reacting faster than manual trading. However, they require proper configuration and monitoring to function effectively.

-

Virtual Private Servers (VPS): Using a VPS can enhance the performance of arbitrage bots by providing a stable and fast internet connection, reducing latency in trade execution.

-

Arbitrage Platforms: Several platforms offer arbitrage services, providing tools and interfaces to facilitate arbitrage trading. It's essential to research and choose reputable platforms with transparent fee structures.

Risks and Challenges

-

Transaction Fees: High fees can erode profits. It's crucial to account for all costs, including trading fees, withdrawal fees, and network fees.

-

Price Volatility: Cryptocurrency prices can change rapidly. A profitable opportunity can vanish within seconds, leading to potential losses if trades aren't executed promptly.

-

Transfer Times: Transferring funds between exchanges can take time, during which price discrepancies may disappear.

-

Regulatory Risks: Different countries have varying regulations regarding cryptocurrency trading. Ensure compliance with local laws to avoid legal issues.

Best Practices for Successful Arbitrage Trading

-

Diversify Exchanges: Maintain accounts on multiple exchanges to access a broader range of arbitrage opportunities.

-

Monitor Markets Continuously: Use tools and bots to keep an eye on price movements and identify opportunities promptly.

-

Start Small: Begin with small trades to understand the mechanics and gradually increase trade sizes as you gain experience.

-

Stay Informed: Keep abreast of market news, regulatory changes, and technological advancements that may impact arbitrage opportunities.

Conclusion

Crypto arbitrage trading offers a viable method to profit from price discrepancies across exchanges. While it presents opportunities for consistent gains, it also comes with challenges that require careful consideration and strategy. By understanding the types of arbitrage, utilizing the right tools, and adhering to best practices, traders can navigate the complexities of the crypto market and capitalize on arbitrage opportunities effectively.